Looking out for Survey Volunteers: We are now giving away a lifetime free copy of our MaoriVibes EA (NZDUSD H1) that’s being used in our real money MAORI portfolio.

Qualify and finish our survey “Decision elements before applying real money funds to trading with a Forex Expert Advisor” (doable in under 3 minutes) and receive a free copy of the MaoriVibes EA at the end.

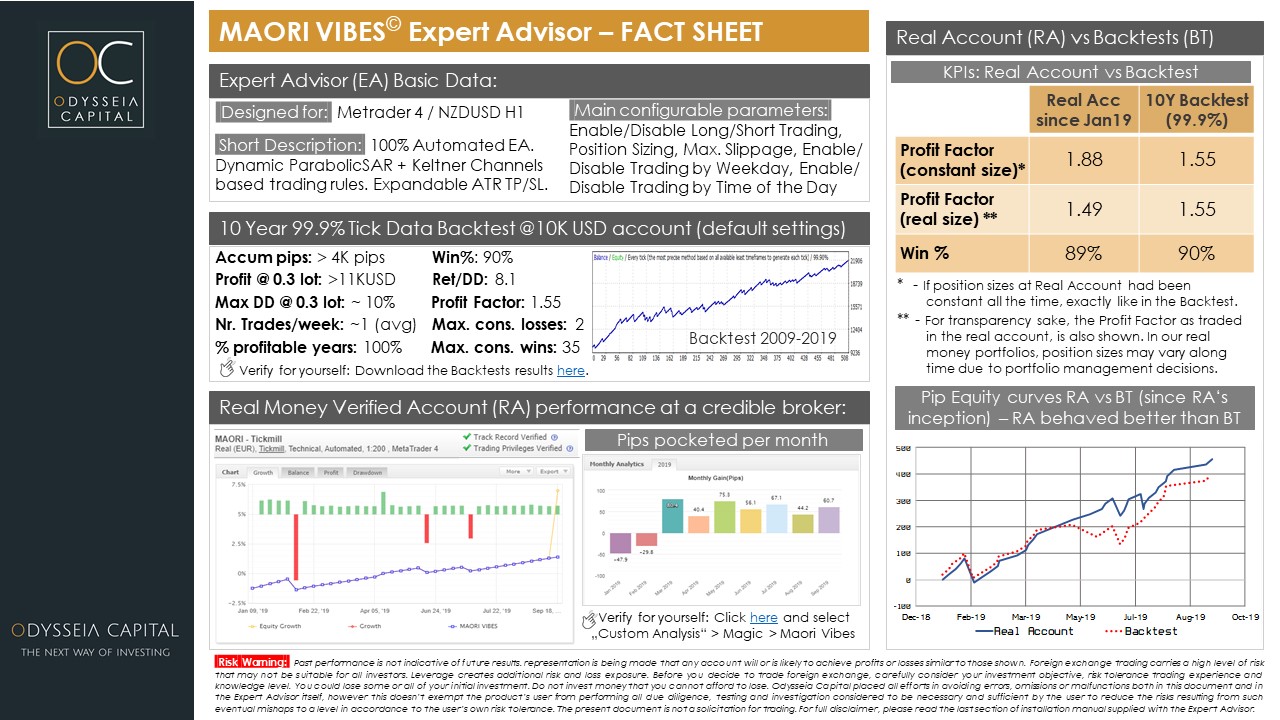

NZDUSD is not the easiest instrument to automate trading, and therefore MaoriVibes can provide an interesting, money-making risk diversification element in your portfolio. It has been working steadily and making money in our Maori Portfolio since January 2019.

Please find the MaoriVibes ExpertAdvisor FactSheet below.

If you have any issue with the survey or the EA, please contact us, using one of the channels at the website.

Thanks for your collaboration!

Odysseia Capital Team