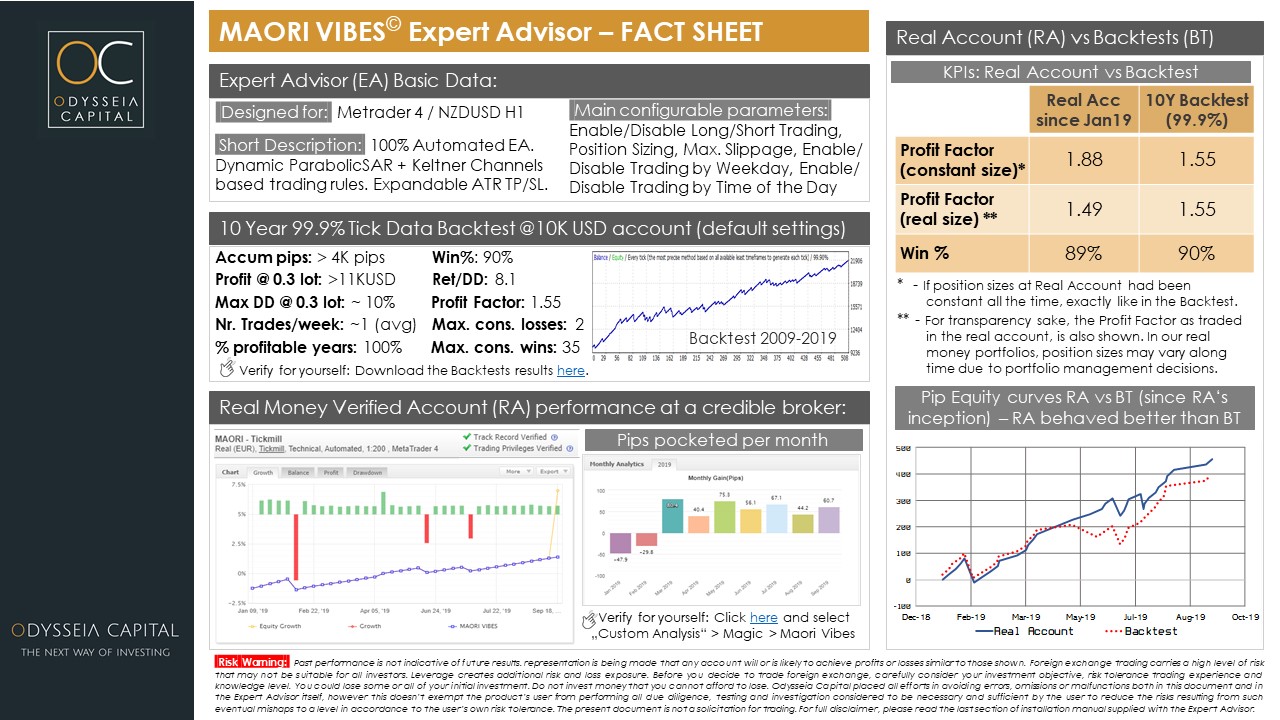

June 2017 ARION Wrap-up – No news is not good news

June 2017 marks the second year in ARION’s lifetime. Unfortunately this is pretty much the only relevant piece of news this month.

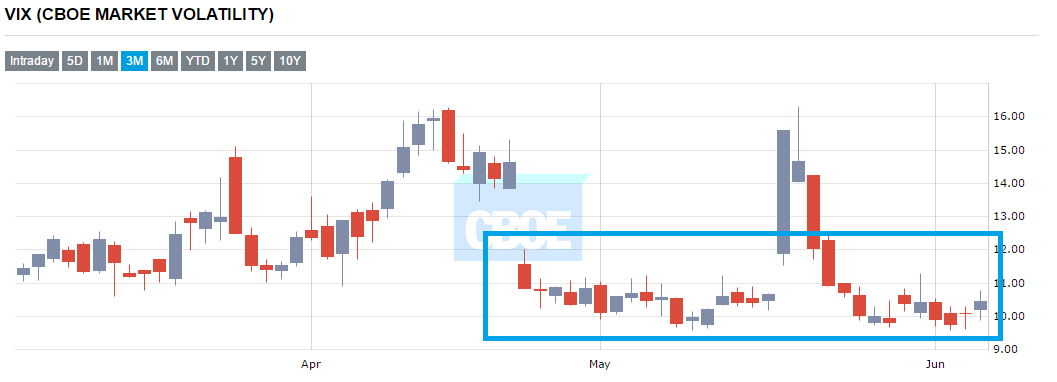

Following a string of several months, the VIX continues at historical low levels, limiting the rebound opportunities to move ARION aways from the plateauing period it has been experiencing since early this year.

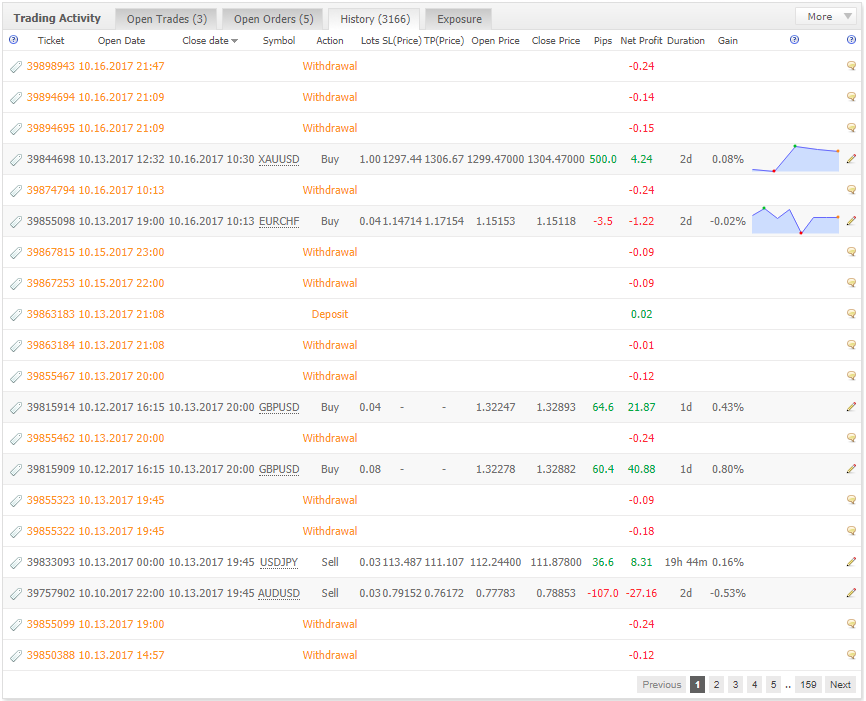

June was basically a “no history month” with a +78 pip performance and a -10 USD profit in our showcase account at ForexTime. The account went nowhere, hurting our compounded monthly return which took another bite (at the end of June was sitting at 1.88% per month).

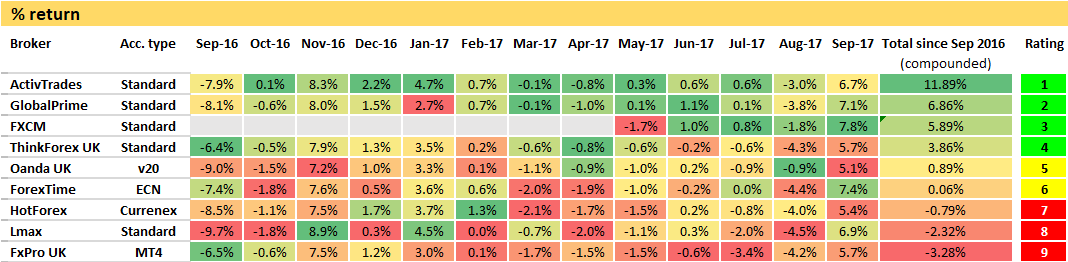

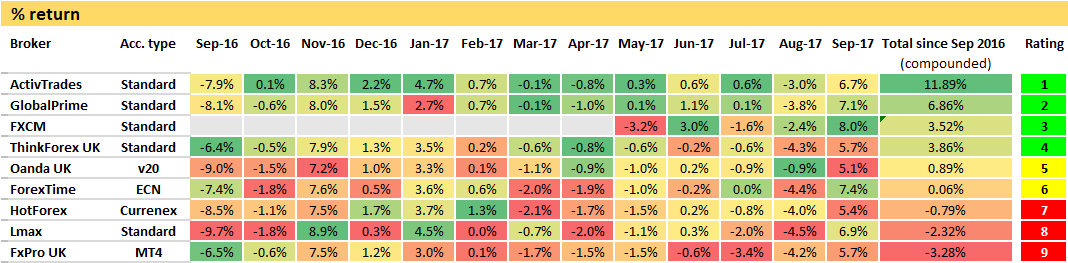

We want to avoid to repeat ourselves month after month, so now we wish to focus on a more interesting topic: Brokers!! (yes, it’s always so interesting to check that there are actually relevant differences between them)!

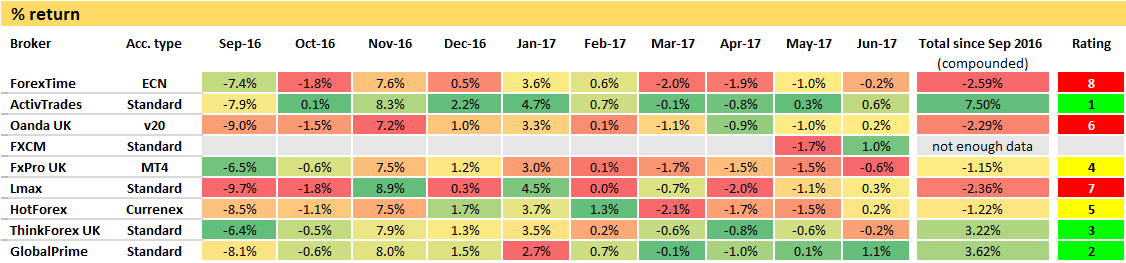

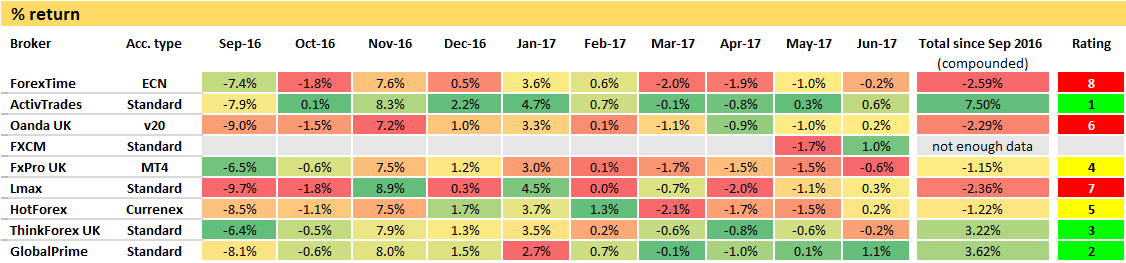

As we see months going by in 2017, we see our showcase account at ForexTime adding up negative months upon negative months. True, at most of the months the negative returns have been close to marginal, yes. However, it’s always distressing to see one’s account adding up negative performance upon negative performance. This is, however, not true for all brokers.

Upon a quick visit to our brokers webpage (https://odysseiacapital.com/resources/brokers/) it’s easy to see that from a pool of brokers running the exact same strategy, results over the months are hardly similar. To our despair, our showcase account at ForexTime (and it’s only so due to its longer history) is the account that has been, since September, the lackluster within the group.

From the pool tested, the best brokers to host ARION strategy have proved to be ActivTrades, GlobalPrime and Thinkforex UK, in this order. This is what our broker comparison tells us over a 9 month period. FXCM seems promising but we still need more data.

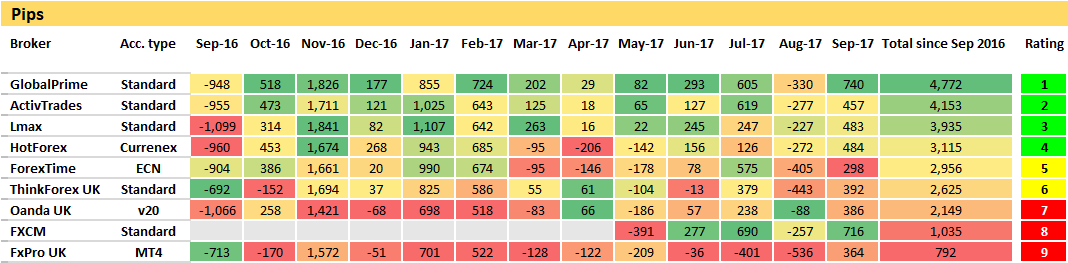

See the table below showing several brokers running the very same ARION strategy:

Table 1 – Broker challenge running ARION over 9 months. The color scheme within each month show the relative performance of each broker when compared with the group in the same month.

Another important result is that when a broker is performing badly, over time, the negative (or positive, depends on which broker one hosts the service) results adds up. See the difference experienced between ForexTime account and ActiveTrades. Over 9 months it ads up to more than 11% return difference. It’s huge!!

Naturally that the performance of some of our customer’s accounts can be quite different from our ForexTime account, even if it is receiving signals from our ForexTime account through distribution channels like simpletrader.net, for instance. It depends at what prices orders are being filled, when signal triggers an order at customers’ accounts.

So, what does this means to our customers ?

While we are under talks with Forex Time to see what is possible to do on their side (we don’t have high expectations though), we are also advising a change to all our customers who might be experiencing something like our ForexTime performance, wish to stick with ARION and believe (as we do) that sooner than later a rebound in the strategy will come picking up again the long term trend of the strategy and the the long term targets defined for ARION.

We usually avoid any advising on what distribution channel we favor or disfavor. In this case however it seems clear some customers might have an advantage by subscribing the service directly through our webpage (as opposed to one of the signal copying services where our signal is also available) and to select ActivTrades (for instance) to host their client account.

Important to notice is that the ActivTrades account is a “Client Account” to our own service (even if owned by us) as any other account from a client would be. Therefore, in case your setup is a subscription through our website and an ActivTrades account to host your account and our signal copier, the expectation would be to track our client ActivTrades account closely. Please be aware however that other factors can also play a role, such as VPS hosting or latency from your computer and ActivTrades trading servers.

If you wish to move your subscription to a direct relationship through our site and our own signal copying service (instead of a marketplace such as simpletrader.net), and have any questions or doubts, please don’t hesitate to contact us. We will try to address all your concerns as soon as possible.

Please take notice that this post is no specific affiliate recommendation on any broker, as we don’t have any commercial relationship of affiliation or receive any rebates or revenues from brokers in any sense. The present post is solely a naked analysis of the facts and the identification of possible more advantageous scenarios to our customers.