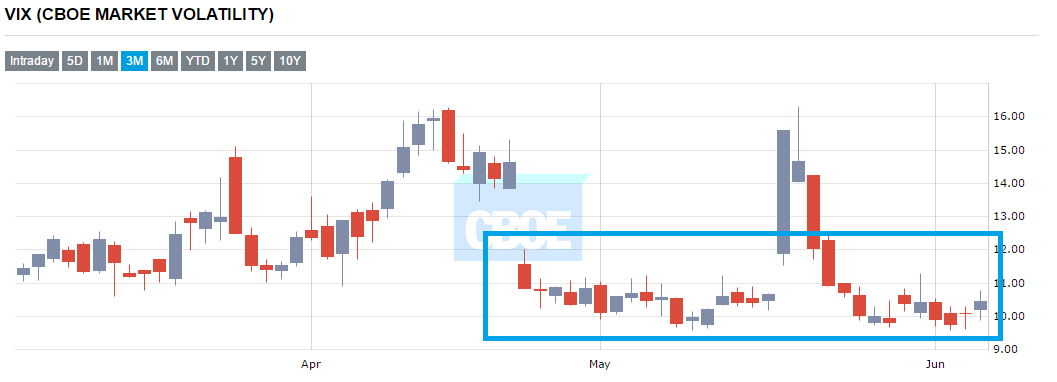

Another month, another low overall volatility period in the markets.

Our outlook for a new high VIX sustained cycle we set out in our last March report did not materialize and throughout VIX maintained itself again in historically low levels. At the time of this post VIX stood at little over 10, already after a 2% daily increase.

Source: CBOE

Naturally we are not satisfied with this kind of numbness in the markets, which is causing ARION to underperform so far this year. For the first time in ARION’s history, May marked the first occurrence of a three month negative results series and a unwanted dip below our long term 2% monthly return target. The fact that it’s also the longest period of low volatility ARION has ever experienced doesn’t leave us anyway less disappointed with the way the last months have shown themselves to ARION.

In benefit of the truth it must also be said that not all of our three sub-strategies in ARION had negative performance. In fact one of the three main strategies had a quite hefty monthly return. Arion benefits from a high degree of diversification, meaning that to enjoy less deep drawdowns one must be able accept that in some months good returns in some of the sub-strategies might be cancelled out by the other parts of the portfolio.

As one bad luck does never come alone (shouldn’t Murphy law work all the time), when around mid month we saw a spike in VIX, the strategy was able to scoop some really nice trades, but unfortunately the server where this FXTM showcase account was running had a severe problem and for some days this account was in fact intermittent on and off the market, missing the best period of the month. Our other account at Activtrades, which was running at a different server had in fact a positive month, mainly due to the nice trades the strategy was able to pocket exactly at the period when VIX spiked and managed to end the month positively. The positive May performance at our Activtrades account can be checked here: https://www.myfxbook.com/members/odysseiacapital/arion-activtrades/1899812

Overall, we can only say we’re regret this development of events and we continue to work hard to recover to our long profitability targets, especially now in this month of June when our strategy is celebrating 2 years in the market. However we really need some help from the kind of volatility we have seen in past years and months – VIX larger than 20 and volatility resulting from unambiguous events easily digested by the markets.