BROKER CHALLENGE – 13 months and 2.000 closed trades later…

So, more than 1 year ago we started a broker contest with the aim to understand in what extent brokers matter, when choosing the right environment to host a client account for a signal service relying in short term strategies like Arion. See more detailed information about our brokers under test in our “Brokers” webpage here.

We have enrolled the following brokers in this challenge:

- Global Prime (Master account in this test)

- FxPro UK

- ThinkForex UK

- HotForex

- Oanda UK

- Forex Time

- LMAX

- ActivTrades

- FXCM (added since May 2017)

More details about each of the account types here.

All brokers’ MT4 trading platforms have been installed in VPS with enough capacity and residing as close as possible to the broker’s servers in order to reduce latency. This means that brokers MT4s trading platforms have been installed in a close to an ideal infrastructure to allow all brokers excel or fail in similar fashion. All accounts are of REAL MONEY so with direct real money investment from Odysseia Capital.

After 13 months and close to 2.000 trades we think it’s now time to take some conclusions. And the conclusions are quite interesting, in our view.

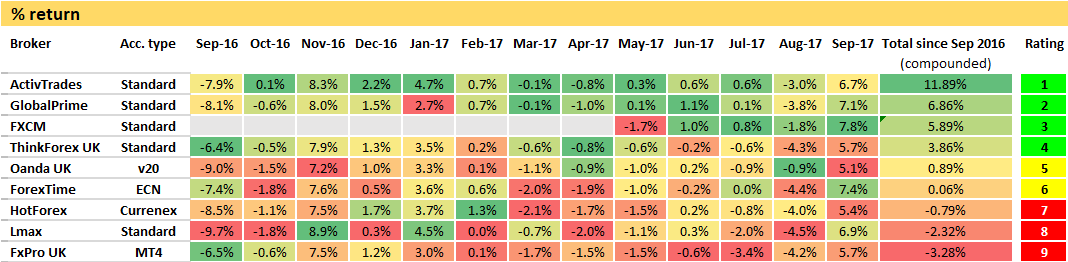

Let’s take a look to the monthly percentage return achieved by each one of the tested brokers. Grading colors mean relative position of each broker in the ranking (green, leading, red lagging)

As it can be noted, the test resulted in huge differences across the board. From a total compounded return of close to 12% in the leading broker (Activtrades) to -3% in the lagging broker (FxPro). It’s a whopping 15% of return in little more than one year. More than enough for opposite decisions between continuing with the signal or drop it.

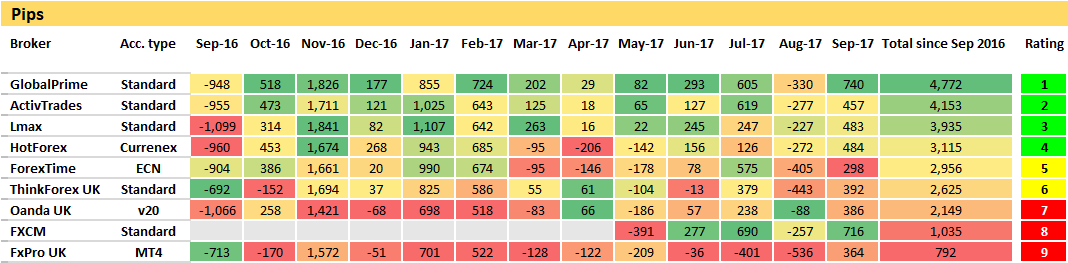

Now, because some accounts have some specifics (for instance Lmax has not always allowed micro lots for Gold trades during the total test) and different instruments can have different different position sizes (as per defined internally by the Arion strategy team) we decided also to also perform a comparison on Pips, which provides a similar, but not totally coincident view:

Please note that FXCM account only joined the test in May and therefore didn’t have the same time available to accumulate Pips. In fact FXCM is one of the accounts we trust will be within the best performers, provided that enough time is allowed.

The main differences we found when making the analysis by Pips are that Lmax jumped to the third place (the Gold trades surely weighted on Lmax) and Hotforex has also jumped up in the ranking, possibly because this account is the only small account in the challenge (with only 2.500 EUR starting capital) so smaller positioning is harder to balance in this account and granularity of positions is not possible.

In brief, our conclusions are:

- When selecting a broker to follow a trading signal (any signal, not only Arion) one should monitor closely the adherence of the its own account to the account of the Signal Provider. There are very significant differences between brokers (and possibly account types), which become very evident when a comprehensive long term test is undertaken.

- When contacted, bad brokers will tell you that they cannot guarantee they have the same prices than other brokers, that their pricing depend on liquidity providers, etc, etc. The reality is that this can all be true, but what matters is that it translates in much worse trading conditions for customers and can transform a profitable strategy into a losing one. It’s as plain as that: prices are different between brokers, but if there was no clear disadvantage in some brokers towards others, over 2.000 trades and 13 months and several market conditions, variability between the brokers should cancel each other. If there are big accumulated divergences between brokers, it means only that brokers with poor performance provide you with worse conditions for the requirements of your strategy. As all in life, some brokers are good, others poor and we should be able to accept that as a plain fact when operating in this market.

About how we will proceed with each broker:

- Regarding FxPro and Oanda, tests will finish immediately. It’s evident enough that the tested accounts don’t make the cut to allow Arion to excel. However, regarding these two brokers we will still initiate two tests in two different account types and give them a second chance. We have contacted both these brokers, which have suggested other account types

- ThinkForex is a puzzle we still have to understand how such a poor Pips performance has still managed to place Thinkforex in the clear profitable group. We still have to decide what to do.

- ForexTime has behaved averagely broker, but we cannot drop it easily as this is our long term history showcase account.

- Hotforex: we believe that it deserves the benefit of the doubt, so we will increase capital in order to give it the same conditions as the other accounts under test.

- Lmax will continue in the challenge. It suffered in the % return due to the overweight of the Gold positions, but now Gold positions in micro lots seem to be allowed, so we expect to perform better from now on.

- FXCM is still young in our test but the performance so far seems to be promising. It will continue in the challenge.

- Active trades is our best in class (client account). It will continue to be part of the challenge.

All accounts in the challenge be assessed here.

All in all, Odysseia Capital is extremely satisfied by having setup this challenge. After 13 months we believe we have provided valuable information to our customers and feel proud that, as far as we know, we are the only signal provider in the world which tests its signals in so many different brokerage environment with significant real money accounts for the sole benefit of our customers.

Note: Odysseia Capital has no relation or affiliation with any broker, other than a normal client/supplier relationship. The above conclusions are not intended to serve as a generic recommendation or evaluation about any broker. The results and conclusions are limited to the scope of the trading within the Arion product, as per described above. When expressions such as “best” or “worse” are used, or alike with similar value, they are to be understood only as within the scope of the test, as per described above.